Chase Bank plans to be open Monday after recent staff-related closures. But be warned – hours may still fluctuate, and that phone tree remains a headache, not a help

Editor’s note- sorry if you clicked the last post and it gave a message about it being spam. It was not. But we had to start over and redo and share differently going forward.

Chase Bank in Fort Bragg has been closed in Fort Bragg several times recently, posting signs saying it was due to staffing problems. Mendocinocoast.news got messages from multiple people last week that the bank was closed, then open, then closed again. A message on the door on Wednesday said the bank was temporarily closed with no timeframe given for reopening. Calling the Chase bank phone tree led Mendocinocoast.news to an answering machine that did not accept messages being left. Callers were directed to either go online or call the JP Morgan 800 number.

Mendocinocoast.news emailed Pablo Rodriguez, public affairs man for JP Morgan’s Chase community banking division. Then we asked why this is happening and if Chase is committed to staying in Fort Bragg. Pablo’s boss, Peter Kelley, lead media relations man for Chase here in California, got right back to Mendocinocoast.news

“Here’s the latest on our Fort Bragg branch. Thanks for reaching out, and we appreciate your interest. It’s important. We had some unexpected staffing issues at our Fort Bragg branch, but we’re actively working to resolve them. The branch is open (Friday) and will reopen on Monday. Our operating times could still vary. We apologize for any inconvenience and thank you for your patience.”

No confirmation yet on the branch’s long-term status. Chase has closed 23 branches this year and has plans to close more in the West and the South. At the same time, Chase is also making a major expansion in New England with nearly that many branches opening there. The company is also taking a big role in crypto banking online and expanding in South Korea.

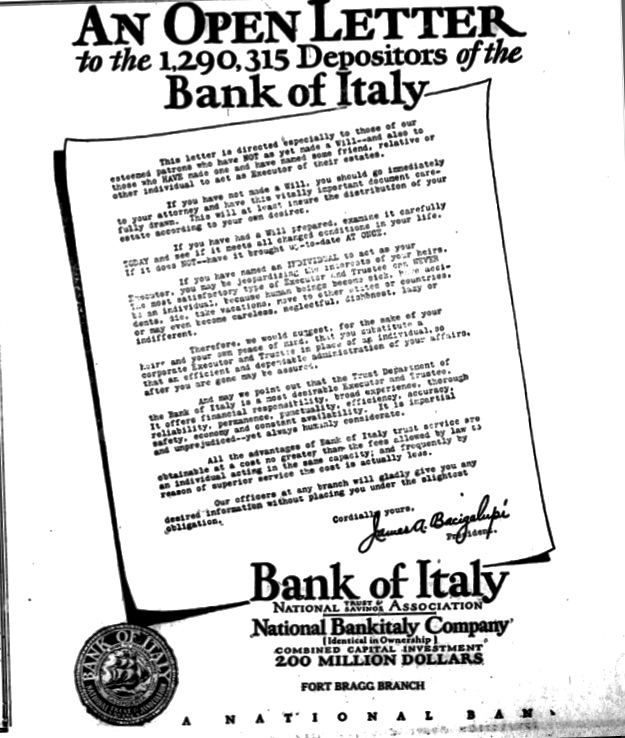

So far, Chase has maintained a stronger presence in Fort Bragg than its two chain bank rivals, Bank of America and Wells Fargo Bank. Wells Fargo moved from what was once bankers row in Fort Bragg and out of its large brick and mortar facility into a kiosk in Safeway. Bank of America had the longest history of any remaining bank in Fort Bragg along with its predecessor, Bank of Italy, but closed its branch, which is now in the process of being turned into a Bear’s Pizza downstairs with housing units possibly to be built upstairs (although this plan has been in the works for several years). When BofA left Fort Bragg in 2018, they left customers at first without even plans for an ATM. That changed when a BofA ATM was installed at the Boatyard Plaza. Fort Bragg Credit Union merged with another credit union before being acquired by Community First Credit Union, which initially operated in two other locations before consolidating into the old Wells Fargo building.

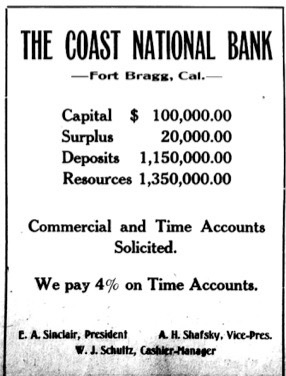

Locally owned banks, before the advent of Wall Street branch banks built Fort Bragg and the Coast. Across the world in Germany, the modern banking system was being created in Germany. When banking was controlled by a tiny cadre of big banks, the economy failed, causing mega inflation and the Nazis. America, powered by small banks and small towns, came to the rescue of the world. Ironically, America came to champion Wall Street over the main street that had made is so strong

Bank of Italy was the first chain bank to arrive in American small towns from San Francisco with more money and conveniences than locals could imagine. Soon the local banks were mostly all gone and they were replaced by other chains. Bank of Italy became the Bank of America, which closed its branch in Fort Bragg entirely eight years ago. Big banks owning everything in the USA was resisted by a 19th century called the National Banking Act. In Europe it led to rapid nationalization and fascism, while America kept its small town strength.

“Savings Bank of Mendocino County, is the only bank chartered in Mendocino County and the only bank headquartered in Mendocino County. This is more than a technicality. This means their headquarters, decision-making, physical facilities, board members, management staff, and employees are all here. Banking Local Matters,” their website said. While Chase has assets in the trillions, the assets of Savings Bank total $1.3 billion. The bank was founded in 1903 and has 171 employees currently, making it one of the largest county employers, larger than all the rest combined.

Chase is a newcomer to Fort Bragg, having bought the former Washington Mutual Savings Bank building in 2010 at 120 E. Alder for $456,000 from a federal receiver.

All Washington Mutual branches were rebranded as Chase Bank in 2009, including Fort Bragg, when WaMu became caught up in the mortgage crisis and was sold off by regulators. Washington Mutual had gotten the property in 2002 from the PM Mortgage Insurance Company, which also went bankrupt from bad mortgage lending. PMI got it from the Franklin Trust, part of a storied local property owner.

Many large corporations have learned they don’t need to keep staff or provide many services to keep customers.

The Fort Bragg Advocate News and Mendocino Beacon’s corporate owners sold off a paid for building on Franklin Street, then paid high rent for a highway location, then announced they were leaving town. The hedge fund that owned the paper was doing massive tax writeoffs this way. There is no location for the newspaper in town and the one staff reporter who lives here. At the same time, many retail chains are eliminating employees in favor of robots. Rite Aid was the latest chain to die in Fort Bragg.

Here is a story Frank Hartzell wrote Wamu failure in Advocate-News .

Chase is the largest bank in the United States by assets with $3.643 trillion. It is the world’s fourth largest bank. Like Wells Fargo and BofA, Chase has a long history of scandals that don’t seem to deter its growing customer base.

For now, two points I can make and maybe should be made.

Someone asked me if the doors being closed during business hours was something of concern for the bank itself. No. Not at all. They were mixing up a branch being closed versus a bank having to close because of shortfalls. There is no law that a branch must have customer service hours if people can access their money another way, such as online or with an ATM card. A bank holiday is a big scary issue. Not at all what is happening here. People have gotten confused by this point on many national sites and according to news accounts in numerous media because of a new practice now being practiced collectively by the major banks- new 24 hour closures. In this case, the media seems to have exaggerated as the truth is that they have simply expanded their holiday schedules. Doing things as a group is a little creepy, but media reports that ridiculously suggested this showed some sort of weakness in banks were totally irresponsible and wrong. Most of the scandal came from right wing media who were angry that banks were now taking Juneteenth as a holiday, publishing boilerplate rage over that issue that has been going around. But its not really about a “woke” holiday. Other holidays including an extra day at the “woke” July 4 holiday are being newly adopted. It’s a shame to see the once – respected Economic Times would print such nonsense.

Chase Bank has loyal customers who really like many of their services, I found out. That being said, if somebody in Fort Bragg is NOT banking at Savings Bank or the Credit Union, they are endorsing Wall Street and financing for far away places, not Mendocino County and our economic vitality. This is actually more important than shopping local or politics. Savings Bank provides the financial backbone for what is left of the local business community. Nobody but local banks truly engage in community-based financing. The loans of Wells Fargo, BofA and Chase mostly go to the chains or massive overseas investments, while the credit union and Savings Bank put local savings into the hands of local businesses.

The big chain banks arrived from the Bay Area in the early 1900s, after a half dozen major local banks had created Fort Bragg’s economy. But the chains were still taking some of the local deposits made in Mendocino County and using those to finance business here until the 1970s, when the big banks became focused on globalist business and mortgages done universally the same way.. Wells Fargo and Bank of Italy, later Bank of America were key to the creation of the California economy and focused business loans on the Golden State up until the 1950s. One can read the loans in the Mendocino County Recorder’s office and follow this money trail. The world’s bankers performed a coup d’etat on the world’s economic system at Bretton Woods in 1944. This was the moment when globalism was born and when the idea that bigger corporations are also better than local business was born. They blamed Nationalism in Germany, Italy and Japan and said the world could no longer be anything but one financial system. They neglected to consider that America had developed from its rural and small town power. Bretton Wood ended local resilience but not the facism of small elites, which turns out to work best when communities have been disempowered through globalsim.

—

Bank of Italy/America in particular, was once a big player Fort Bragg’s growth. However, even then these large banks created a much more oligarchical economy in California than smaller banks had created back East. And they exercised control of politics and even some of the dark sides of the economy. Mega farms were created in California along with a culture that kept the Central Valley, in particular, impoverished with no hope of buying a small farm in most places. You can verify this history in the Mendocino County Recorder’s Office, which still has open public records, unlike the private access club called the Mendocino County Superior Court. Fort Bragg was among the first places to join the Occupy Wall Street protests that spung up on Wall Street in 2011 with massive scale and even clashes between squatting protesters who had the temerity to block bankers on the way to their towers in the sky. The big event lasted 57 days and weekly protests broke up in two years. Weekly protests lasted until at least 2016 in Fort Bragg, where nobody squatted or blocked. Ridiculously, the Wikipedia entry for Occupy Wall Street terms it leftist and fails to report its premise- bank local and shop local. Those are actually the most conservative, common sense ideas ever.

In the end it’s simple – banking locally is the wisest choice for stability, service and community care.